Insights

The following information is marketing material and expressly not an offer within the meaning of FinSa.

Unkorrelierte Renditen in einem herausfordernden Marktumfeld

Webinar

Market Update: Rentenpyramide

Market Update

February 26, 2026

Der Übergang zu kapitalgedeckten Renten hat Aktienmärkte mit strukturellen Zuflüssen aufgebläht. Steigende Pensionsvermögen trieben Bewertungen und KGVs. Dreht die Demografie, könnten Fonds zu Nettoverkäufern werden. Droht eine systemische Belastung für Märkte und Finanzstabilität?

Market Update: Not so smart Alpha

Market Update

February 26, 2026

Alpha gilt als Beweis für Managerkompetenz, ist aber stark modellabhängig. Benchmarkwahl, Beta Anpassung und Faktormodelle verzerren die Messung teils erheblich. Ein positives Alpha kann Modellfehler statt echter Outperformance sein. Investoren sollten Ergebnisse kritisch hinterfragen.

Market Update: Währungsabsicherung

Market Update

February 26, 2026

USD Engagements in Hedgefonds erhöhen für CHF Anleger Volatilität und Drawdowns ohne zwingenden Mehrertrag. Eine systematische Währungsabsicherung stabilisiert Renditen, schützt die Diversifikationswirkung und verhindert, dass FX Schwankungen das Manager Alpha überlagern.

Market Update: Im Fokus

Market Update

February 26, 2026

Breit diversifiziertes Aktienportfolio mit 5 bis 8 alternativen UCITS Fonds regionaler Spitzenmanager. Ziel ist es, an steigenden Märkten zu partizipieren und in Korrekturen Kapital zu schützen. Täglich liquide Struktur für flexible Allokation in anspruchsvollem Umfeld.

Market Update: Ausblick 26

Market Update

February 26, 2026

2025 war stark, 2026 startet positiv, doch Bewertungen sind hoch und Risikopraemien tief. Die Wahrscheinlichkeit einer Korrektur steigt. Jetzt gilt es, Gewinne zu sichern und das Portfolio mit liquiden, negativ korrelierten Strategien wie Global Macro oder Long Short zu diversifizieren.

New York Trip Report Sept 25 PAR

Trip Report

January 5, 2026

Peter Rice visited 22 managers in New York during his 4-week stay. AI Capex and central bank policy remain key themes. Managers focus on dispersion and catalyst-driven trades, with tech, semis, and healthcare as core exposures. Most use concentrated longs with active, tactical hedging.

London Trip Report Oct 25 DF

Trip Report

January 5, 2026

David Friche met 14 managers across Macro, Commodity, and Digital Assets. Macro managers remain cautiously optimistic, commodity managers favor metals, and digital asset funds continue to deliver alpha despite market volatility. AI seen as a key driver of future opportunities.

London Trip Report Oct 25

Trip Report

December 1, 2025

Davor Cvijetic met 9 managers focused on European equities and event-driven strategies. Strong equity markets, AI-driven trends, and revived M&A activity—highlighted by the USD 55 bn EA deal—are fueling returns, with targeted shorts and German legal arbitrage adding alpha.

Local Commodity Trip Report

Trip Report

December 1, 2025

David Friche met 9 managers—some on-site in Zug, others at a Zurich conference or via video—to assess trends in commodity hedge funds. With new launches on the rise, investor interest is clearly returning, driven by the appeal of uncorrelated, asymmetric return profiles.

London Trip Report July 25

Trip Report

November 27, 2025

Peter Rice met 11 managers in London: they remain constructive on European equities, citing attractive valuations, improving cycle indicators, and international revenue exposure. Sentiment suggests the “European trade” is under-owned, creating a favourable setup for contrarian positioning.

Interesting Studies and Press Articles: Rise

Update

October 30, 2025

A new study shows why U.S. pensions shifted from equities to alternatives: not risk appetite, but rising return expectations. Hedge funds stand out as the most dynamic allocation. Consultant views play a central role—making alternatives key to long-term diversification.

Interesting Studies and Press Articles: Implementation

Update

October 30, 2025

Matt Kavian challenges the myth of pure skill: it's not better signals, but better implementation that drives outperformance. His model shows how constraints, crowding, and market impact shape results—highlighting why smaller allocations often deliver more alpha.

The dilemma of Swiss bond investors

Update

Why CB Global Trading Keeps Smiling: YTD 10.48%

Webcast

October 2, 2025

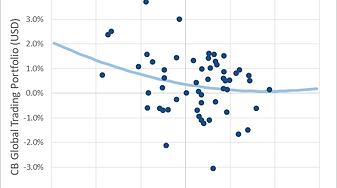

Tariffs, fragile data and geopolitics keep markets uneasy. David Friche explains why CB Global Trading keeps smiling—converting dislocations into convex, uncorrelated returns via active macro and selective strategies. Key takeaways: convex alpha, diversification, downside resilience.

New York:

Trip Report

May 1, 2025

Davor Cvijetić and Ivo Felder visited more than 20 managers in New York. Their discussions highlighted regime shifts, opportunities in healthcare, renewed convertible issuance, and evolving fund structures – offering valuable insights into today’s hedge fund landscape.

Hong Kong Trip Report

Trip Report

July 10, 2025

Stefan Steiner met 11 managers in Hong Kong: they remain constructive on Asia, highlighting China’s recovery potential, value in Japan, strong merger arbitrage dynamics, and regional inefficiencies. A surprise TWD move rattled markets, raising concerns about JPY or HKD volatility.